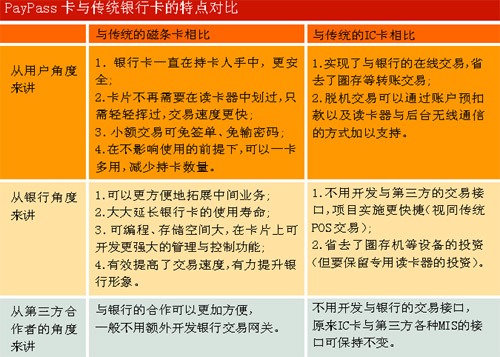

Because of its good security and convenient use, bank IC cards have wider application prospects than magnetic stripe cards. Especially in the field of micropayments of less than 1,000 yuan, IC cards can fully utilize the flexibility and speed of payment. The PayPass card integrates the traditional programmable IC chip and the RFID supported by the current standard ISO 14443 (see RFID Bulletin February issue), while using the chip, PIN and RFID technology to achieve contactless payment. It integrates the advantages of an IC card and provides a high level of security. In June, the theft of 40 million credit card information in the United States shocked the world. MasterCard (MasterCard International Credit Card Company) said that because the computer network of the credit card data processing center was invaded, 40 million credit card accounts and effective dates were stolen, and so far, at least 6,800 cases of fraudulent credit card consumption have been caused. This incident once again puts the safety of the magnetic stripe card in front of us. Bank card crimes in these years have long been nothing new. Why are bank card crimes increasingly rampant? The key reason is the flaws in magnetic stripe card technology. Criminals can easily steal data from magnetic strips and copy them onto new cards. The chip card (ie smart card or IC card) is more difficult to copy than the magnetic stripe card, and the cost of financial crime is much higher. To this end, Europay, Mastercard, and Visa have been working hard to promote EMV migration, that is, bank cards are transferred from magnetic stripe cards to smart IC cards. At the same time, three international credit card organizations are also innovating on bank cards. In 2003, MasterCard integrated RFID technology into IC cards and launched a new bank card, which has breakthroughs in security and payment convenience, and is expected to bring some new revolutions to the field of electronic payment. This is the PayPass technology. What is PayPass? PayPass is a wireless payment technology introduced by MasterCard International in 2003 and has been promoted globally since 2004 (see RFID RF Express). On the surface, this technology is similar to the non-contact IC card technology that has already been used, but it has a new technical meaning. This type of card (hereinafter referred to as the PayPass card) integrates the traditional programmable IC chip and the RFID supported by the current standard ISO 14443, while using the chip, PIN and RFID technology to achieve contactless payment. With the support of these technologies, cardholders can complete traditional forms of banking transactions by simply swiping the bank card in front of a dedicated contactless card reader (which can be understood as a dedicated POS), instead of requiring the card to be used as before. Swipe through the card reader slot. The PIN can retain the cardholder's detailed information, so that when the transaction process needs to verify the identity, the special merchant can conveniently view it, and the PIN can also retain a certain amount of historical transaction details. The IC chip inherits the advantages of large storage capacity and programmable capacity of traditional IC cards. Banks can use it to develop powerful functions such as security, information storage, and user management that cannot be realized on ordinary magnetic stripe cards. At the same time, PayPass has the functions that traditional IC cards do not have. For example, an IC card cannot be directly traded with the bank's back office, and needs to be transferred to a bank through a transaction such as a deposit or a circle, and the PayPass card can be directly associated with the bank backend like a magnetic stripe card. A seemingly simple technical implementation will open up a new application direction for us. The core breakthrough of PayPass technology is the integration of IC cards with traditional bank card applications through RFID technology. It integrates the advantages of the IC card and brings a high degree of security. In the whole process of the transaction, the card has been in the hands of the card holder, and some traditional pseudo-card crime means no longer work. In addition, MasterCard also permits, under certain conditions, small transactions to be exempted from signing, free of passwords, etc., making it simpler, more convenient and faster. In addition, when the conventional magnetic stripe card is swiped, the disadvantages such as the wear of the card, the additional requirement for the card swiping action, and the time delay occurring when the magnetic stripe information is read are also overcome to some extent. According to foreign statistics, the single transaction time of the Paypass card can be shortened by up to 64%! The promotion value of the "e-wallet" of bank cards has been rapidly increased. Compared with the traditional magnetic stripe card and IC card, the bank IC card supported by Paypass technology has some obvious advantages. We can see from the comparison of the following table. To use a PayPass card requires a dedicated card reader device, the user can choose to install an additional card reader or a dedicated POS machine on a traditional POS. In order to maximize the protection of current investment in bank card applications, MasterCard is committed to being compatible with traditional magnetic stripe cards. Moreover, the card can be combined with the "contact" and "non-contact" information exchange methods, and can realize the dual interface of the magnetic stripe card and the IC card. That is to say, magnetic strips can also appear on current PayPass cards, which can be used on POS machines that support different interfaces. In order to reduce the cost, it is also possible to integrate only the RFID chip on the conventional magnetic stripe card, and no longer integrate the IC chip of the conventional meaning, of course, at the expense of the programmable function. The application prospect of PayPass technology Since RFID technology can be applied to different application environments, PayPass can be applied to some environments where magnetic cards and IC cards are not suitable. In addition, through the division of storage units, one card can be applied to different subsystems at the same time. Octopus (Octopus card), which is very popular in Hong Kong, uses this feature to be widely used in supermarkets, public transportation systems, restaurants, hotels and other places of consumption. . From the bank's point of view, on such a card, it integrates multiple functions such as proxy medical insurance, collecting traffic fines, collecting taxes, etc., so that one card can be used for more purposes, and the current cardholder's "one thing, one card" is changed. status. At present, traditional mobile phone companies such as Motorola are working with MasterCard to study the possibility of combining PayPass technology with mobile phones. With the support of RFID technology, the NFC (Near Field Communication) system can be established on the mobile phone to realize the wireless communication between the mobile phone and the PayPass reader, and automatically complete the transaction association with the bank card account, thereby achieving beyond the traditional plastic base. Contactless payment of the card. MasterCard even considers the direct implementation of the reader (ie dedicated POS) function on the mobile phone, making the mobile phone an expandable payment system. At present, mobile phone manufacturers such as Motorola and Nokia have launched mobile phone products with integrated payment functions: Motorola has external NFC function on the phone case, and Nokia claims to have successfully integrated NFC chips in the mobile phone motherboard. Related businesses are optimistic that the future of Paypass mobile phones will be loved by fashion seekers, and the age of “free payment†may be in sight. The technology was first promoted in the United States at the end of 2003 and won the unanimous appreciation of 16,000 cardholders and more than 60 merchants. Taiwan Province of China also became the second region in the world to promote the technology in February this year. At present, MasterCard International is working hard to promote PayPass technology. Its target customers are located in fast food, supermarkets, stations, theaters, etc., which are characterized by large passenger flow, small transaction amount, long queue time and fast transaction speed. A number of vendors have announced support for the technology, including chip makers Infineon, Atmel, Philips, Samsung, card makers Colorado Plastics Inc., First data Co., and POS machines Verifone, OTI, Hypercom ( Haibotong, Vivotech, etc. The difficulties faced by PayPass technology Of course, there are still many obstacles to PayPass on the way forward. Like other new technologies, the biggest problem that hinders the development of PayPass technology is the standard, especially the standard problem of RFID technology. At present, there are two major RFID standard camps in the world: Auto-ID Center in Europe and America and Ubiquitous ID Center (UID) in Japan. China's own national standards are believed to be released as soon as possible. When international standards, national standards, and corporate standards come together, problems like WAPI and 3G promotion may happen. In addition, the cost issues associated with the compatibility and replacement of magnetic stripe cards also constrain the promotion of this technology. Although MasterCard is committed to protecting the investment in magnetic stripe card applications, it can only be said to be an expedient measure, both technically and in the long-term commercial interests. How to steadily carry out related technology replacement and migration (ie, current hot issues in the industry: EMV migration), it is necessary to take into account factors such as the user's acceptance speed and the related research and development of related businesses, and the factors such as the ability of banks to withstand the retirement of old equipment and the interest game between relevant international organizations. There are many variables in between. In addition, there are some issues that will have a negative impact on the application of PayPass technology. For example, because transaction intensiveness may cause bandwidth, transaction preloading device overload and corresponding business management issues, but these can be understood as "sweet troubles" for the bank side. (Author: Wu Juntao is the Science and Technology Department of the Agricultural Bank of China Tangshan Branch, Liu Yanli is the Science and Technology Department of the Agricultural Bank of China Hebei Branch, Mu Yang is the Finance Department of North China Coal Medical College) link EMV migration EMV is the collective name of Europay, Mastercard and Visa. It represents the financial payment application standard for smart cards and was upgraded in 2000. EMV migration means that bank cards are transferred from magnetic stripe cards to smart IC cards. The purpose is to effectively prevent financial intelligence crimes such as multinational production and use of fake credit cards and credit card fraud. The EMV-compliant CPU chip uses new data encryption technology and intelligent technology, with independent computing, encryption and decryption and storage capabilities. ATM and electronic cash register system readers read some information from the chip when they read information from the chip. The security program can be mutually authenticated with the acquiring system, which can greatly improve the security of bank card payment and reduce fraud. The three major international credit card organizations spared no effort in the implementation of EMV migration, and decided to assume responsibility for the losses caused by various false and fake cards in the magnetic stripe card still in use in Europe since 2005. At present, there are more than 25 million MasterCard smart cards in the Asia Pacific region, but the number of such cards in China is still rare. Shuan Ghaidan, vice president of advanced payment systems for Asia Pacific, MasterCard International, predicts that China's EMV migration project will have substantial progress by the end of 2006 or early 2007. In China, Shanghai has begun to carry out EMV migration, and its implementation plan was submitted to the municipal government for consideration in February. UnionPay has started relevant technical tests in June this year. In the second half of the year, it will be piloted in cities such as Shanghai, Beijing and Shenzhen. It is possible to select two large banks to conduct tests in a small area and then roll them out across the country. Intimate gel,women wash,vaginal gel,yoni oil Zchoise Cosmetic Factory , https://www.zchoise.com The reason why this technical concept has not been promoted in the past is mainly because the speed of wireless data transmission is too slow, and there is the possibility of information leakage. In recent years, the development of new technologies, especially the development of RFID technology, has made this possible.

The reason why this technical concept has not been promoted in the past is mainly because the speed of wireless data transmission is too slow, and there is the possibility of information leakage. In recent years, the development of new technologies, especially the development of RFID technology, has made this possible.